Frequently Asked Questions

Contents:

Questions for the Investment Options Report

These are the input questions that will enable us to project future financial outcomes. As a subscriber, you can run reports with different inputs.

- What is the age of the person being projected?

[If there are two people being projected, write down the older person**] - What is the size of the total superannuation investments?

- How much might be withdrawn?

- What is Person 1’s current annual contributions to superannuation (usually paid by the employer)?

[This should be at least 9.5% of your pre-tax annual income**] - If Person 1 is making additional contributions to their super fund, how much is it?

- What annual amount of insurance premiums is paid by Person 1’s super fund?

- At what age does Person 1 expect to retire?

- Does Person 1 expect to have any extra income in retirement? If so, how much and for how many years?

- If there are two people being projected, what is the age of the second person? [Leave blank if there is no second person]

- What is Person 2’s current annual contribution to superannuation?

- If Person 2 is making additional contributions to their super fund, how much is it?

- What annual amount of insurance premium is paid by Person 2’s super fund?

- At what age does Person 2 expect to retire?

- What proportion of your superannuation is in areas such as the stock market (here and overseas), and property?

- What annual fixed fee is charged by the super funds?

- Super funds also charge a fee as a percentage of the size of the fund. What is that percentage?

- Do you own a home?

- What is the maximum insurance premium as a percentage of the annual contribution?

- At what age does insurance stop?

- What is the length of time in retirement at which we report the probabilities of various income levels?

- What is the annual rate at which real salary increases above CPI?

- What is the expected annual real return on growth assets?

This is the annual return above inflation. - What is the expected annual real return on defensive assets?

- What is the volatility of return for growth assets?

- What is the volatility of return for defensive assets?

- What is the correlation of returns?

- What is the reversion to the mean parameter for growth assets?

- What is the reversion to the mean parameter for defensive assets?

General questions

We will process your inputs into our algorithms immediately and email the Report to you within 2 minutes or sooner. Let us know if you have not received it within 15 minutes.

The enhancements that we anticipate delivering in the 12 months of your subscription include:

• Out of workforce (including being unemployed now)

• Optional access to asset allocation of fund, e.g. by your SMSFs accountant or super fund manager

• More asset classes and asset allocation discussion

• Retirement report

• Goal-directed investments with education as one of the goals.

After purchase, your subscription will automatically renew in 12 months. However, we will advise you in advance of the annual subscription renewal 6 weeks, 3 weeks and 1 week in advance of the renewal. If you do not wish to renew the subscription, you will need to cancel by simply clicking the cancel button in your accounts dashboard.

- Enter your name and email, enter a password, Keep track of your password.

- Use the coupon by entering the name of the Coupon into the coupon box.

- Click anywhere on the page.

The credit card questions will disappear. - Tick the boxes re Terms of Service and Privacy

- Click on the button (‘Sign up for mProjections’).

The mSmart mProjections Report is not a financial product and mSmart does not offer any financial products although Affiliates might offer financial products.

Data Security

Yes, very much so. mProjection data is encrypted using the same technology as the major banks. Personal identifies are detached to data that is transmitted over the net.

mProjections does not keep any such data. Payments are processed on Stripe or PayPal and the data is secured within the Stripe or PayPal system.

Accreditation of the algorithm

The algorithm has been built by Dr Frank Ashe who is an Executive Director of Mafematica Pty Ltd, ABN 30 167 364 552, and an Honorary Associate Professor at Applied Finance Centre (AFC), Macquarie University. He holds a PhD in Statistics (more commonly known today as data science). His career has been in investment banking and life insurance where he utilised his considerable mathematics, statistics and risk management experience to work in a number of senior executive roles prior to joining academic and more recently, Mafematica.

Dr Ashe is also a Lecturer for the Actuaries Institute and an International speaker on related topics – Behavioural Finance, Risk Management and complex mathematical solutions.

The results of the algorithm have been compared with , and are similar to 2 publicly available sets of figures prepared on recognised quality web sites / and or authors, and have been compared to the ASIC sponsored calculator (although ASIC’s calculator does not include as many results as we calculate).

Technical Questions to do with Superannuation

Yes, in the optional questions there is the opportunity to add non-superannuation assets.

Non-superannuation assets are assumed to earn a rate of return that can contribute to the estimated steady income in retirement.

Income from the Age Pension is automatically calculated.

Annuities are also modelled.

Yes, however if you enter other investment assets in the ‘Advanced settings – other’ section, they will be included in Centrelink calculations as an asset, and income deemed according to Centrelink’s deeming rules.

If Person 1 has additional income in retirement, it may have an effect on their pension amount.

No, this calculator only works for accumulation funds.

In general No, this calculator only projects income at a steady rate throughout your retirement. However, you can specify that additional income needs to be available for a specified range of ages. This additional income is in addition to the steady income in retirement.

Person 1 can specify that they will receive additional income, perhaps from part-time work, in retirement. The calculator takes this into account when estimating the total steady income in retirement.

You can’t select your retirement income but you can change your retirement income estimate by changing your retirement age, your personal contributions or any of the fields in the ‘Advanced settings’ sections.

The minimum pension you must withdraw each year is calculated as a percentage of your balance, for example at age 65, you must withdraw 5% of the account balance each year. The minimum percentage will increase at age 75 and every 5 years thereafter until you reach age 95.

As your account balance decreases your Age Pension may increase which means you would need to draw less super pension to maintain your income.

Income is estimated before tax although super and Age Pension income is tax free for most people over age 60.

The calculator defaults to expected returns for a diversified portfolio of Growth assets and Defensive assets. Investment options can be changed in the ‘Advanced settings’ sections for the fund.

Yes, in the Advanced questions section, you can change the length of time in retirement you want your super pension to last.

All amounts are in today’s dollars. A forecast cash flow of $100 in 50 years should buy the same shopping cart of groceries as it would today.

Yes, however you will need to make sure you include all fees, including accounting and auditing fees. Also make sure the rate of return and asset allocation is appropriate for the fund.

This calculator does not allow for one-off super contributions. If you are projecting an example of someone close to retirement you could change the super balance to reflect the lump sum contribution expected to be made.

Annuities

Our Retirement Income projections also includes a basic annuity product.

There are a number of annuity products on the market, with new ones appearing regularly. Because we are doing medium- and long-term projections it is impossible for us to model all these possibilities for a potentially long time in the future. However, something needs to be done because annuities are an important tool to protect income levels if you live much longer than expected.

Our retirement income annuity projections model is based on the techniques used by some current annuity providers. We use this approach because it requires the least number of assumptions about future conditions in the investment markets and the market for annuities. In our questionnaire for the annuity projections all the important numbers, such as age, are able to be set by the user.

Annuities can be purchased by either, or both, of Person 1 and Person 2, at a specified age. The purchase price can be set as a dollar amount or as a percentage of the size of the superfund of the Person. We recommend using a set dollar amount only for annuities being purchased in the near future, as the size of the fund in the medium-term and long-term is uncertain.

The purchase amount is invested in a separate, externally managed annuity fund using a specified asset allocation. Fees are paid to the fund manager. Over time the value of the fund changes as markets fluctuate in value.

For each year that the annuity holder is alive there is a set percentage of the fund paid out as income. This percentage changes slightly as the person gets older**.

When the annuity holder passes on, the remainder of the fund remains with the annuity provider. (Because we currently do not model the possibility of death before the age of 100, the fund is never forfeited in our projection.)

___________________________________________________

** The reason it isn’t a constant is a consequence of the need by providers to significantly reduce the cost for insurance companies that provide the greater certainty on the annuity payments. This cost saving is passed on to the annuity buyer. (Yes! it really is! We’ve reviewed the methodologies, which are beyond the scope of this FAQ.)

Affiliate Program

An Affiliate is a financial planner, accountant, stockbroker, education and newsletter provider, services provider to Self-Managed Superannuation Funds (SMSFs) or their providers, and other general participant, in the financial services industry who has clients that may benefit from the purchase of a Mafematica service.

Affiliates may earn a referral fee for the introduction of their web site to the Mafematica services.

To enable affiliates to earn a referral fee on sales of Mafematica services that are promoted by the affiliate on their web site and where a client purchases a Mafematica product following an introduction by the Affiliate.

The purpose is achieved by the Affiliate registering with Mafematica’s Affiliate Program and receiving a unique code which is issued by Mafematica as a distributor and becomes recognised by the Mafematica Payments system to enable a referral payment to be made by Mafematica to the Affiliate upon a successful purchase by the client.

By visiting our mProjections website and registering through the Affiliate system here.

Click here to register to become an Affiliate.

TO CHECK: Go to the Next Steps Section of the Report template and On the Home page, click the “Sign On” link and enter your email address, and a password. This activates the access to the payments system and the unique code – which in turn will activate the referral payments.. and activates “Sign In” button access by which further Affiliate Program pages (link located in bottom menus) can be password protection navigated.

Select the “Affiliates Sign In” link at the top of any mProjections page, enter your email address and password, press the “Sign In” button, and then navigate to the Affiliate Program page (link located in the bottom menu).

$10 in referral fees must be earned before a payment is issued.

Payments are calculated on the 1st of the month. If $10 or more in referral has been earned, then a payment is made. If less than $10 is earned, that amount will be carried forward to subsequent months (e.g. January earnings total $3 and February earnings total $8, a payment will be issued for $11).

Payments can be made through PayPal.

In the affiliate links, there is a special code that is unique for each affiliate. When someone comes to our site using an affiliate link, we record the code in a cookie. Any purchases made in the next 365 days will be credited to you.

The Combination program allows you to allocate up to 15% of the value of the referral sale to a referral or you can choose to pass along a discount to your clients. (e.g. 15% referral, 30% discount, 15% referral and 15% discount etc). [NEEDS better explanation]

On the “Traffic and Stats” tab, you can generate reports to view your current figures. On the “Payments” tab, you can see when payments have been issued.

You earn referral on all services we provide (including initial subscription purchases). You do not earn referral on fees that are site subscription renewals.

Your affiliate discount can be applied to all mProjections services except site subscription renewals and fees that are paid to an outside agency.

This disclosure is made in compliance with Regulatory Guide (RG) 168: Product Disclosure Statements (and other disclosure obligations) Issued by the Australian Securities & investments Commission on 28 October 2011.

Referral fees:

mProjections advises that third parties (or ‘Affiliates’) might make the Report available to visitors to their (the third party) web sites or to their social media followers, and that the third party may earn a referral fee in these circumstances.

An Affiliate is a party that joins the Affiliate program promoted by mProjections on its web site.

A third party is any party that:

1. has registered as an Affiliate on the mProjections web site, including any party that has been referred by an existing mProjections Affiliate

2. includes the mProjections link on its web site and makes the mProjections Report available for its clients / members / visitors to purchase, or

3. a party who promotes this Report via social media.

The third party may be a financial services professional business or any other party that makes its web sites or social media available to the public whether or not the web-site or social media is open to selected members or the public at large.

A referral fee may be paid by mProjections to such third parties of no less than $12.75 including GST. If there are more than one referrer third parties, the total fee may be up to $25.50. These fee levels assume the recommended retail price of the Report is $85.00 including GST.

Referral fees are not payable by clients as an additional fee to the cost of the Report: the fees are payable by mProjections to the third party.

Additionally, a referral fee is payable by mProjections to the third party, or b/ where the client has visited the third party and later buys the mProjections Report directly with mProjections. The latter arrangement can occur via the use of cookies in the client’s computer and the ‘life’ of the referral fee arrangement via the cookie. This may continue for up to one year or any other period selected by mProjections and the third party.

The fee will be paid by mProjections to third parties from the fee paid by the buying client, and will be paid within 2 months of the client’s purchase.

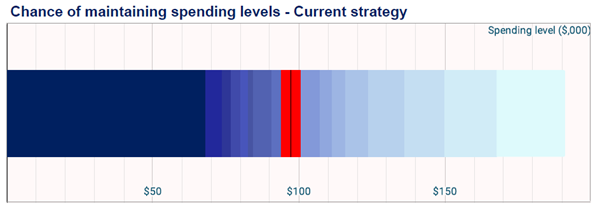

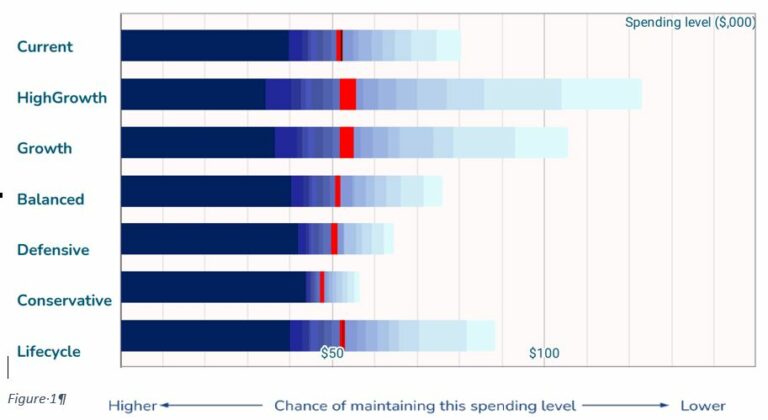

Understanding our charts

The Income Bar Chart shows the likelihood of a spending level being maintained for 25 years in retirement. The darker the colour, the more likely that the spending level will last.

The number of years in retirement (25 is default), and the Current strategy (default is 65% in Growth assets) can be changed by the user in Advanced Questions.

The Multiple Asset Allocation chart shows the likelihood of a spending level being maintained for 25 years in retirement for a variety of Investment Strategies (Asset Allocations). The darker the colour, the more likely that the spending level will last.

The number of years can be changed by the user in Advanced Questions.